November 26, 2022 / 14 Minute Read

a brief history of money

You remember the old saying “money doesn’t grow on trees” right?

Well what if I told you it did?

What if I told you that there’s literally no difference between the American dollar and a piece of computer paper?

What if I told you that the government can literally print money out of thin air?

Well it’s all true.

Throughout this series we will evaluate how the Federal Reserve system has dupped the world into using funny money as well as their end goals, using The Creature from Jekyll Island as a reference.

However, before we expose this world-changing, game-breaking, “conspiracy;” we have to understand the basics.

For volume 1 of this series, I wanted to provide a brief history of money, as well as the concepts and principles that define a working system of money. Once we understand how a righteous money system works, we will be able to evaluate how the Federal Reserve system is in complete opposition to these ideas.

what is money?

Before we can understand how and why modern society uses fake money. We must understand what real money is.

Money is anything which is accepted as a medium of exchange and it may be classified into the following forms:

1. Commodity money

2. Receipt money

3. Fiat money

4. Fractional money

Via: The Creature from Jekyll Island: Pg. 138.

pre-money

Before there was any kind of money, however, there was barter, and it is important first to understand the link between the two. Barter is defined as that which is directly exchanged for something of like value. Mr. Jones swaps his restored Model-T Ford for a Steinway grand piano. This exchange is not monetary in nature because both items are valued for themselves rather than held as a medium of exchange to be used later for something else.

Note, however, that both items have intrinsic value or they would not be accepted by the other parties. The concept of intrinsic value is the key to an understanding of the various forms of money that evolved from the process of barter.

Via: The Creature from Jekyll Island: Pg. 138.

So essentially money is anything that can be used as a medium of exchange that also has intrinsic value.

Remember the term intrinsic value when we get to the sections on fractional and fiat money.

commodity money

In the natural evolution of every society, there always have been one or two items which became more commonly used in barter than all others. This was because they had certain characteristics which made them useful or attractive to almost everyone. Eventually, they were traded, not for themselves, but because they represented a storehouse of value which could be exchanged at a later time for something else. Among primitive people, the most usual item to become commodity money was some form of food, either produce or livestock.

Eventually, when man learned how to refine crude ores, and to craft them into tools or weapons, the metals themselves became of value. This was the dawning of the Bronze Age in which iron, copper, tin, and bronze were traded between craftsmen and merchants along trade routes and at major sea ports. The primary reason metals became widely used as commodity money is that they meet all of the requirements for convenient trading. In addition to being of intrinsic value for uses other than money, they are not perishable and easily transportable.

Perhaps the most important monetary attribute of metals, however, is their ability to be precisely measured. It is important to keep in mind that, in its fundamental form and function, money is both a storehouse and a measure of value. It is the reference by which all other things in the economy can be compared. It is essential, therefore, that the monetary unit itself be both measurable and constant. The ability to precisely assay metals in both purity and weight makes them ideally suited for this function. Experts may haggle over the precise quality of a gemstone, but an ingot of metal is either 99% pure or it Isn’t, and it either weighs 100 ounces or it doesn’t.

Via: The Creature from Jekyll Island: Pgs. 139,140.

Once again commodity money is items exchanged with intrinsic value, that can be exchanged for something else in the future. These include crops, livestock, and precious metals.

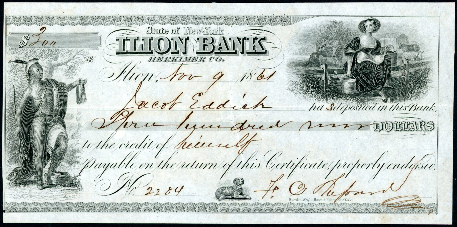

receipt money

When a man accumulated more coins than required for daily purchases, he needed a safe place to store it. The goldsmiths, who handled large amounts of precious metals in their trades, had already built sturdy vaults to protect their own inventory, so it was natural for them to offer vault space to their customers for a fee. The goldsmith could be trusted to guard the coins well because he also would be guarding his own wealth. When the coins were placed into the vault, the warehouseman would give the owner a written receipt which entitled him to withdraw at any time.

At first, the only way the coins could be taken from the vault was for the owner to personally present the receipt. Eventually, however, it became customary for the owner to merely endorse his receipt to a third party who, upon presentation, could make the withdrawal. These endorsed receipts were the forerunners of today’s checks. The final stage in this development was the custom of issuing not just one receipt for the entire deposit, but a series of smaller receipts, adding up to the same total, and each having printed across the top: PAY TO THE BEARER ON DEMAND.

As the population learned from experience that these paper receipts were truly backed by good coin in the goldsmith’s warehouse and that the coin really would be given out in exchange for the receipts, it became increasingly common to use the paper instead of the coin Thus, receipt money came into existence. The paper itself was useless, but what it represented was quite valuable. As long as the coin was held in safe keeping as promised, there was no difference in value between the receipt and the coin which backed it.

Via: The Creature from Jekyll Island: Pgs. 151,152.

We now understand the beginning of the banking industry. As coins began to form the dominant form of commodity money, people needed a safe place to keep their wealth.

They turned to goldsmiths, as they already had established safes and protection. They could also be trusted because they would be protecting their own money as well. Depositors were given receipts to verify their savings, which eventually led to the first form of paper money.

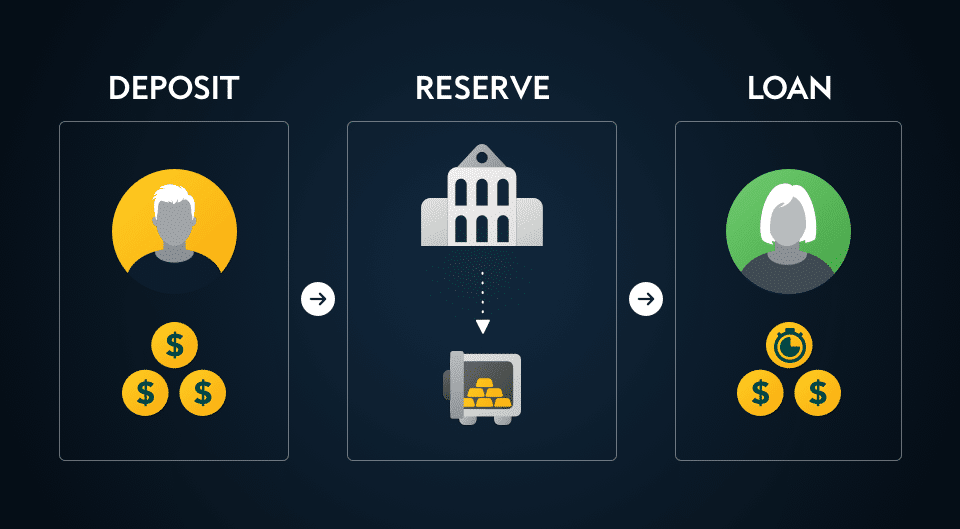

fractional-reserve banking

In addition to the goldsmiths who stored coins, there was another class of merchants, called “scriveners,” who loaned coins. The goldsmiths reasoned that they, too, could act as scriveners, but do so with other people’s money. They said it was a pity for all that coin to just sit idle in their vaults. Why not lend it out and earn a profit which then could be split between themselves and their depositors? Put it to work, instead of merely gathering dust. They had learned from experience that very few of their depositors ever wanted to remove their coins at the same time. In fact, net withdrawals seldom exceeded ten or fifteen per cent of their stockpile. It seemed perfectly safe to lend up to eighty or even eighty-five per cent of their coins. And so the warehousemen began to act as loan brokers on behalf of their depositors, and the concept of banking, as we know it today was born.

When the bankers used those coins as the basis for loans, they were putting themselves in a position of not having enough coin in the vault to make good on their contracts when it came time for depositors to take their money home. In other words, the new contracts were made with the full knowledge that, under certain circumstances, they would have to be broken. But the bankers never bothered to explain that. The general public was led to believe that, if they approved of putting these supposedly idle funds to work, they would be helping the economy and earning a little profit besides. It was an appealing proposal, and the idea caught on like wildfire.

Most borrowers wanted paper money, of course, not bulky coins, so, when they received their loans, they usually put the coins right back into the vault for safekeeping. They were then given receipts for these deposits which, as we have observed, were readily accepted in commerce as money.

At this point, things began to get complicated. The original depositors had been given receipts for all of the bank’s coins. But the bank now issued loans in the amount of eighty-five per cent of its deposits, and the borrowers were given receipts for that same amount. These were in addition to the original receipts. That made 85% more receipts than coins. Thus, the banks created 85% more money and placed it into circulation through their borrowers. In other words, by issuing phony receipts, they artificially expanded the money supply. At this point, the certificates were no longer 100% backed by gold. They now had a backing of only 54% (100 units of gold divided by 185 certificates equals .54) but they were accepted by the unsuspecting public as equal in value to the old receipts. The gold behind all of them, however, now represented only a fraction of their face value. Thus, the receipts became what may be called fractional money.

Via: The Creature from Jekyll Island: Pgs. 165,167.

We see now that fractional money is essentially money worth only a portion of it’s perceived value. The banks loan out more money than they have, which makes the loans they issue worth a much lower amount than proclaimed.

Modern banks employ this same practice. They loan out your money and charge interest on the loans, which is how banks make money. This is dangerous however, because they are essentially stealing money from their depositors without the means to pay them back.

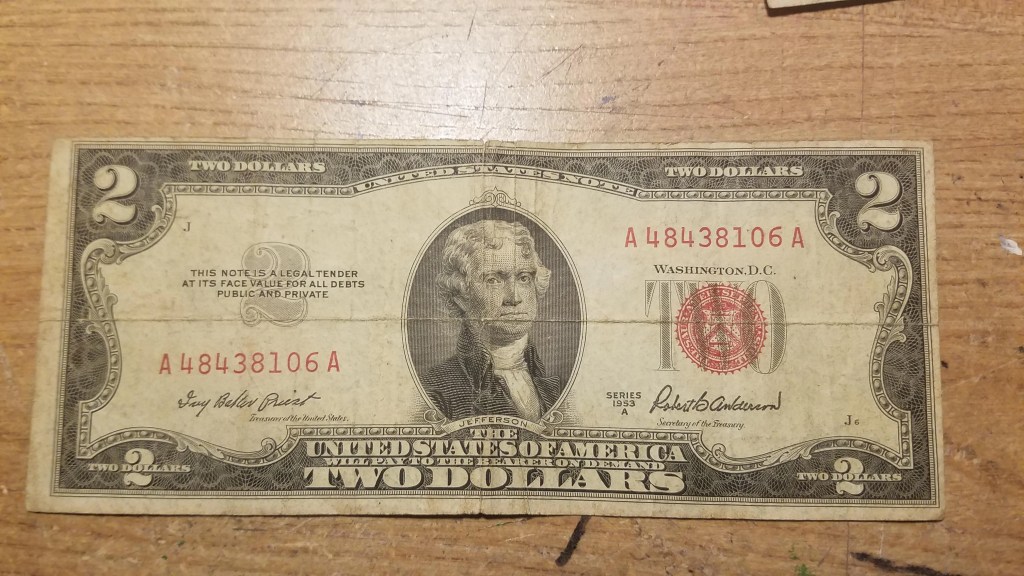

fiat money

Fiat money is paper money without precious-metal backing and which people are required by law to accept. It allows politicians to increase spending without raising taxes.

The American Heritage Dictionary defines fiat money as “paper money decreed legal tender, not backed by gold or silver.” The two characteristics of fiat money, therefore, are (1) it does not represent anything of intrinsic value and (2) it is decreed legal tender. Legal tender simply means that there is a law requiring everyone to accept the currency in commerce. The two always go together because, since the money really is worthless, it soon would be rejected by the public in favor of a more reliable medium of exchange, such as gold or silver coin.

From this perspective, we can now look back on fractional money and recognize that it really is a transitional form between receipt money and fiat money. It has some of the characteristics of both. As the fraction becomes smaller, the less it resembles receipt money and the more closely it comes to fiat money. When the fraction finally reaches zero, then it has made the complete transition and becomes pure fiat.

No bank can stay in business for very long with a zero reserve. The only way to make people accept such a worthless currency is by government force. That’s what legal-tender laws are all about. The transition from fractional-reserve money to fiat money, therefore, requires the participation of government through a mechanism which is called a central bank.

Thus, when governments issue fiat money, they always declare it to be legal tender under pain of fine or imprisonment. The only way a government can exchange its worthless paper money for tangible goods and services is to give its citizens no choice.

Via: The Creature from Jekyll Island: Pgs. 155, 164, 168, 169.

So we see now that money does in fact grow on trees.

Fiat money is literally just paper that the government says is money, because it has no assets of intrinsic value to validate it.

This is how corporate bailouts, stimulus checks, and PPP Loans are possible. They literally create money out of thin air.

inflation

From the very beginning, the desire for a larger money supply led to practices which were destructive to the economy. Unscrupulous merchants began to shave off a tiny portion of each coin they handled—a process known as coin clipping—and then having the shavings melted down into new coins. Before long, the king’s treasury began to do the same thing to the coins it received in taxes. In this way, the money supply was increased, but the supply of gold was not. The result was exactly what we now know always happens when the money supply is artificially expanded. There was inflation. Whereas one coin previously would buy twelve sheep, it would now only be accepted for ten. The total amount of gold needed for twelve sheep never really changed. It’s just that everyone knew that one coin no longer contained it.

Fiat money is the means by which governments obtain instant purchasing power without taxation. But where does that purchasing power come from? Since fiat money has nothing of tangible value to offset it, government’s fiat purchasing power can be obtained only by subtracting it from somewhere else. It is, in fact, “collected” from us all through a decline in our purchasing power. It is, therefore, exactly the same as a tax, but one that is hidden from view, silent in operation, and little understood by the taxpayer.

Fiat money is the cause of inflation, and the amount which people lose in purchasing power is exactly the amount which was taken from them and transferred to their government by this process. Inflation, therefore, is a hidden tax. This tax is the most unfair of all because it falls most heavily on those who are least able to pay. the small wage earner and those on fixed incomes. It also punishes the thrifty by eroding the value of their savings. This creates resentment among the people, leading always to political unrest and national disunity.

Via: The Creature from Jekyll Island: Pgs. 147, 162, 165.

Nothing is free.

Many people were ecstatic at the beginning of the Covid pandemic, as the government issued billions of dollars in loans and stimulus checks.

However, we are now paying for these loans through decreased purchasing power manifested in higher gas and food prices. It’s essentially like getting a raise at your job, but simultaneously having all your bills increase at the same time.

summary

Knowledge of the nature of money is essential to an understanding of the Federal Reserve. Contrary to common belief, the topic is neither mysterious nor complicated. For the purposes of this study, money is defined as anything which is accepted as a medium of exchange. Building on that, we find there are four kinds of money: commodity, receipt, fiat, and fractional. Precious metals were the first commodity money to appear in history and ever since have been proven by actual experience to be the only reliable base for an honest monetary system. Gold, as the basis of money, can take several forms: bullion, coins, and fully backed paper receipts.

Man has been plagued throughout history with the false theory that the quantity of money is important, specifically that more money is better than less. This has led to perpetual manipulation and expansion of the money supply through such practices as coin clipping, debasement of the coin content, and, in later centuries, the issuance of more paper receipts than there was gold to back them. In every case, these practices have led to economic and political disaster. In those rare instances where man has refrained from manipulating the money supply and has allowed it to be a free-market production of the gold supply, the result has been prosperity and tranquility.

Via: The Creature from Jekyll Island: Pg. 152.

In volume 2, we will discuss the history of the Federal Reserve, and how they use fiat money and fractional-reserve banking to control the economy, as well as society itself.

Bye chance.

references

Griffin, G. Edward. The Creature from Jekyll Island: A Second Look at the Federal Reserve. American Media, 2010.